Sustainable investing has been growing rapidly over the last decade. A recent survey found the COVID-19 pandemic has actually accelerated sustainable investing trends, with many investors now planning to double their share of sustainable investments in the next five years.

In short, sustainable investing means selecting companies (or other investments) based, at least in part, on their performance in managing environmental, social, and governance (ESG) issues. While some investors do their own research to understand a company’s performance, many rely on ESG ratings published by major investor research organizations. These organizations give companies an ESG rating (such as A for strong performers, and C for average performers) based on public reporting and other information provided by the company.

In short, sustainable investing means selecting companies (or other investments) based, at least in part, on their performance in managing environmental, social, and governance (ESG) issues. While some investors do their own research to understand a company’s performance, many rely on ESG ratings published by major investor research organizations. These organizations give companies an ESG rating (such as A for strong performers, and C for average performers) based on public reporting and other information provided by the company.

These ratings work similarly to credit ratings, in that they provide a proxy for investors to understand the level of ESG risk associated with a particular investment. High ESG ratings signal competent management of ESG issues and point to a company that may be capitalizing on ESG-related opportunities. Low ESG ratings indicate that a company may not understand the impact of ESG issues on its operations. Low ratings may also provide a leading indicator for ESG-related failings which often directly impact the company’s financial performance.

The importance of waste and materials for investors

Dr Alex Gold leads the North American operations for sustainability advisory firm BWD, which specializes in helping companies optimize investor sentiment through better corporate reporting. He explains that “China’s ban on importing recycling and ongoing public frustration around the prevalence of single-use plastics have combined to rapidly increase the importance of organizational waste management for investors. They now see poor waste management as a key liability and view the circular economy as a huge opportunity for companies to establish a competitive advantage.”.

The growing importance that investors place on waste management is demonstrated by the fact that nearly all ESG ratings in existence today include waste management and materials used as key indicators.

The growing importance that investors place on waste management is demonstrated by the fact that nearly all ESG ratings in existence today include waste management and materials used as key indicators.

For example, companies earn a place on the Dow Jones Sustainability Index through strong scores in the S&P Global Corporate Sustainability Assessment. An organization’s total waste production, the ambition of its waste reduction targets, its approaches to recycling, and its strategies to reduce materials use are all included in the organization’s final score.

Another example is provided by ISS – a major investor research organization that prepares reports about corporate performance. These reports play an influential role in informing voting on shareholder resolutions, among other investment decisions. The ISS Environmental & Social QualityScore, as well as the ISS ESG Corporate Rating, include an assessment of organizational waste management practices, targets, and performance over time.

Dr Gold argues why organizations need to take these investor ESG ratings seriously: “When an issue like waste management is included in a rating assessment, it strengthens the link between the issue and a company’s financial performance. This is because if you are able to increase your rating through strong waste management, it could lead to your company’s inclusion on ESG-focused indices like the Dow Jones Sustainability Index. Being included on more indices means more demand for your stock, which in turn leads to share price appreciation. On the other hand, if these ratings flag an issue such as materials use as a concern in their reports, it increases the investor perception of risk associated with your company. This negatively impacts sentiment, limits your company’s capacity to attract new forms of investment such as sustainability-linked bonds, and potentially increases your cost of capital.”

From ratings to regulation

From ratings to regulation

With so many investor ESG ratings and reporting frameworks now in place, investors and companies alike are calling for some sort of standardization to make sense of corporate sustainability performance. The most promising standard that has emerged so far comes from the European Union, which has proposed a taxonomy (the ‘EU Taxonomy’) that companies would need to use when reporting to investors on their sustainability performance.

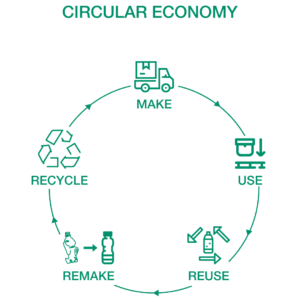

One of the objectives in the EU Taxonomy is the transition to a circular economy, which has major implications for the strategic importance of waste. As Dr Gold explains: “By including the circular economy as an objective alongside longstanding focus areas like climate change mitigation and adaptation, regulators in the EU are signaling that the issue should be of strategic importance for companies and their investors. Once the EU Taxonomy comes into force, companies will be expected to have a clear strategy for supporting the circular economy and this includes a focus on their waste management practices.”

BWD is an advisory firm specializing in organizational sustainability strategy and reporting, with offices in the United States, Australia, New Zealand, and Malaysia. Dr Alex Gold leads BWD’s US office out of New York City, and can be found on LinkedIn here.